Tax Groups allow you to define sales tax rates to apply to inventory items. For example, food processing supplies may be taxed differently from cleaning supplies or equipment.

If an item is assigned to a Tax Group, the tax for that item will be calculated and included in the tax amount on purchase orders and invoices.

If an item is not assigned to a Tax Group, tax will not be added.

You can skip this section if you do not need to calculate tax on Purchase Orders or Invoice Accrual.

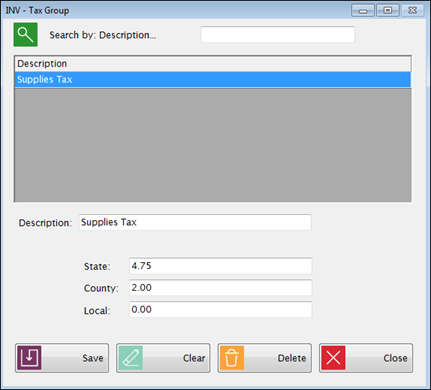

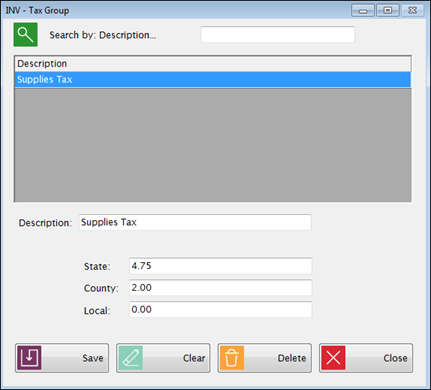

Enter a Description for the Tax Group.

Enter the applicable tax percentages under State, County and Local and click Save.

If anything is entered under Local Tax, it will be combined with County taxes when the general ledger is updated for POs or Invoices.