Import Account Info

Notes about Importing Data

Imported data is generally read-only in the Financial screens.

-

If data is imported for a fiscal year,

the data entry screen for that year is not editable.

-

This is done in order to keep imported

data synchronized with the general ledger that you are interfacing

with.

-

If changes are required, they need

to be done in the general ledger and picked up in Financial by running

another import.

Imported and manually entered data can’t be mixed within the same fiscal

year.

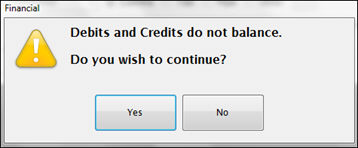

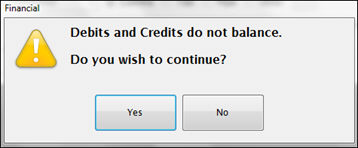

If Debits and Credits do not balance in the general ledger, you will

get an error message but you can continue with the Import if you wish.

Import from LINQ and Sunpac General Ledgers

This gets all accounts for the selected fiscal year from the LINQ or

Sunpac general ledger where Fund = 5

and PRC = 000, 001 or 035 or ALL. It also gets beginning balance,

beginning budget, monthly activity, and budget/PO activity.

-

Account #

and Description are imported

from the general ledger and cannot be changed in Financial.

-

Account Types

are based on the standard NC chart of accounts.

-

Account Categories,

Subcategories, and FC1A

line numbers are set up as needed and assigned to accounts based

on the standard NC standard chart of accounts.

-

Prorate Account

is not checked or unchecked automatically on Import. It is only updated

from Financial.

-

Indirect

Cost is checked by default for

expense codes with Object codes 100-199, 200-299, 312, 332, and 411.

However, if Indirect Cost settings are changed in Financial, the changes

will not be overwritten on the next import.

-

A

warning message will display if Debits and Credits are not equal.

You can still run the import, but Financial reports (Trial Balance

and FC1A) will not be balanced.

- This

warning message could be due to one or more things:

- Finance

has started using fund 5 for something other than child nutrition and

the General Ledger does not balance by PRC (Program Report Code).

- Fund

5 as a whole is not balanced. Finance sometimes ‘rolls’ balances

from 6/30 (previous fiscal year) and that can throw off the debits and

credits.

- Click

YES to continue and troubleshoot

this message. It will

then populate Meals PlusFinancial so the user can

view the amount/month the debits/credits are off (run Trial Balance or

the FC1A). Take note of which month the accounts were out of

balance to help Finance determine the amount, or when the accounts became

out of balance. Once corrections are made in the General Ledger,

another Account Information Import will pull the changes from the

General Ledger into Meals Plus,

and debits and credits should be equal again.

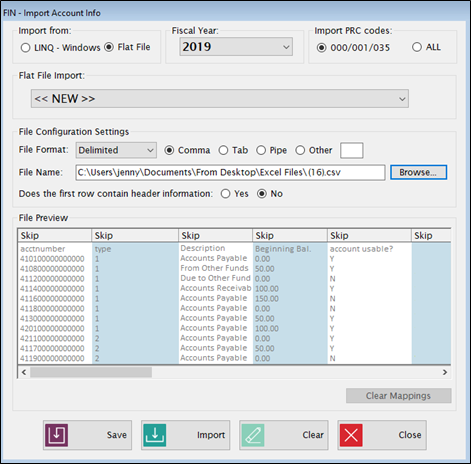

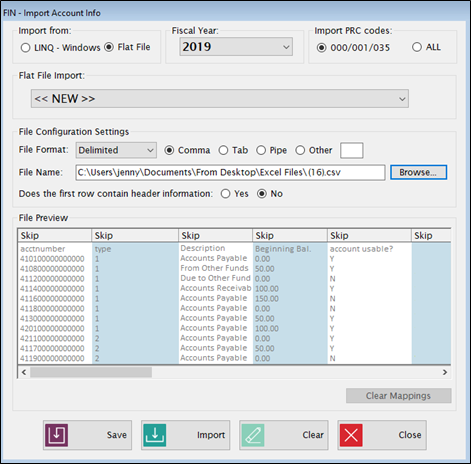

Flat File Import

This may be used to import account data if a connection to the general

ledger database is not available or for general ledger type Other.

-

The required fields for Import (Flat

File) are Account Number, Description and Account Type. This will

give the minimum information that you need to set POS Accounts so

you can Export Journal Entries and Update General Ledger from Accountability.

-

If you want to run Financial reports

that include account activity, you will also need to import the beginning

balances and monthly activity. Budget and PO data are optional.

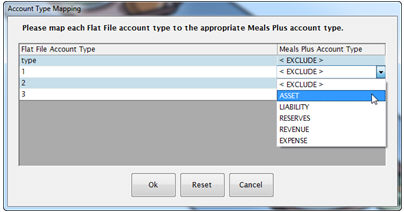

File Configuration Settings

File Preview

-

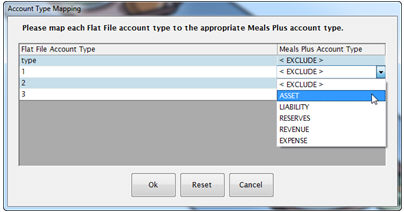

Map the data columns to corresponding database

fields.

-

Click

on a column heading to open a dropdown list of available fields and

select the appropriate one.

-

If you are

using a Fixed format: to select a column, highlight the first character

and then hold down the shift key and click on the end character.

©2018

EMS LINQ Inc.

www.mealsplus.com

FIN version 9 Help, revised 10/2018